The smart Trick of Clark Wealth Partners That Nobody is Discussing

Table of ContentsThe Clark Wealth Partners IdeasThe 15-Second Trick For Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyClark Wealth Partners Things To Know Before You BuyClark Wealth Partners Can Be Fun For EveryoneThe smart Trick of Clark Wealth Partners That Nobody is Discussing

The world of money is a complicated one., for instance, recently found that almost two-thirds of Americans were incapable to pass a standard, five-question economic literacy test that quizzed individuals on subjects such as rate of interest, financial obligation, and various other relatively basic ideas.In enhancement to managing their existing clients, financial advisors will certainly usually invest a reasonable amount of time each week meeting with prospective customers and marketing their solutions to preserve and grow their company. For those thinking about becoming an economic consultant, it is essential to consider the ordinary income and task security for those functioning in the field.

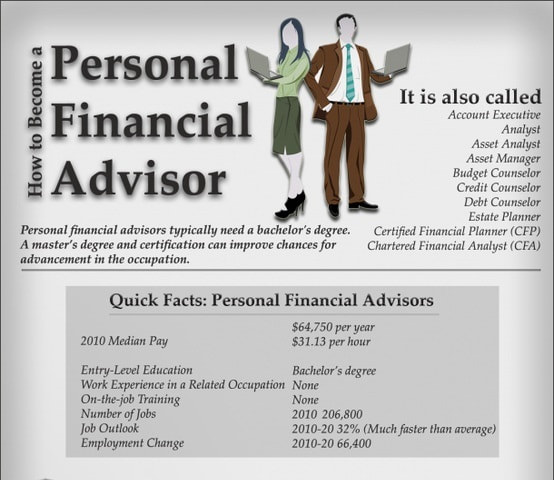

Programs in tax obligations, estate planning, investments, and risk management can be valuable for trainees on this course. Relying on your one-of-a-kind job objectives, you may likewise need to make details licenses to accomplish certain clients' demands, such as dealing supplies, bonds, and insurance plan. It can additionally be useful to make a certification such as a Certified Economic Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

7 Easy Facts About Clark Wealth Partners Described

Lots of people choose to get assistance by utilizing the services of a financial professional. What that looks like can be a variety of points, and can vary depending upon your age and phase of life. Before you do anything, study is vital. Some individuals worry that they need a certain amount of money to spend prior to they can obtain assist from a specialist.

The 10-Minute Rule for Clark Wealth Partners

If you have not had any experience with an economic advisor, below's what to anticipate: They'll begin by supplying a complete analysis of where you stand with your assets, liabilities and whether you're fulfilling benchmarks compared to your peers for cost savings and retired life. They'll evaluate brief- and lasting goals. What's helpful about this action is that it is individualized for you.

You're young and working full time, have a cars and truck or two and there are trainee car loans to settle. Right here are some possible ideas to help: Develop good cost savings behaviors, pay off debt, set standard objectives. Settle student car loans. Depending upon your occupation, you might qualify to have component of your institution finance forgoed.

Unknown Facts About Clark Wealth Partners

You can discuss the next finest time for follow-up. Prior to you start, inquire about rates. Financial consultants normally have various tiers of prices. Some have minimum possession degrees and will certainly charge a charge typically a number of thousand bucks for developing and changing a strategy, or they might bill a level fee.

You're looking in advance to your retirement and aiding your youngsters with greater education and learning costs. A monetary consultant can use recommendations for those scenarios and even more.

Facts About Clark Wealth Partners Uncovered

Set up routine check-ins with your planner to modify your plan as needed. Stabilizing cost savings for retired life and university prices for your youngsters can be tricky.

Thinking of when you can retire and what post-retirement years could appear like can generate concerns concerning whether your retired life cost savings remain in line with your post-work strategies, or if you have conserved sufficient to leave a tradition. Assist your economic specialist understand your strategy to money. If you are extra conventional with saving (and prospective loss), their ideas ought to react to your worries and worries.

Clark Wealth Partners Fundamentals Explained

Planning for health care is one of the huge unknowns in retirement, and a monetary professional can detail alternatives and recommend whether extra insurance coverage as protection might be valuable. Prior to you start, try to obtain comfy with the idea of sharing your whole monetary photo with a professional.

Offering your professional a complete photo can help them develop a strategy that's focused on to all parts of your monetary condition, especially as you're quick approaching your post-work years. If your finances are basic and you have a love for doing it yourself, you might be fine on your own.

An economic expert is not only for the super-rich; anybody encountering significant life shifts, nearing retirement, or feeling overwhelmed by financial choices can gain from professional advice. This post explores the role of economic consultants, when you may require to get in touch with one, and crucial considerations for picking - https://experiment.com/users/clrkwlthprtnr. A monetary advisor is an experienced specialist that aids customers handle their financial resources and make informed choices that straighten with their life goals

The Only Guide to Clark Wealth Partners

In contrast, commission-based experts make earnings via the monetary items they sell, which may affect their referrals. Whether it is marital relationship, separation, the birth of a child, occupation changes, or the loss of a liked one, these occasions have special financial effects, frequently calling for timely decisions that can have enduring impacts.